Rothko Investment Strategies believes Income-oriented, Value equities remain the most significant dislocation since the “Dot-com Bust”.

We systematically build high realized dividend yielding portfolios of names with strong fundamentals and high intrinsic value. With bond yields at all-time lows and Growth stocks deep in bubble territory, we believe asset allocators should be positioned in sustainable, Income-oriented, Value portfolios.

The Unprecedented Opportunity in Income-oriented Value Equities

The Rising Stars of Tomorrow: EM Small Cap

In a world of low and negative yields, an overvalued US$ and volatile sentiment on global trade, we pose three simple questions: 1. What is the most inefficient area of the global equities universe? 2. What has the highest alpha potential? 3. Which area of global equities is due a cyclical rebound? The answer to […]

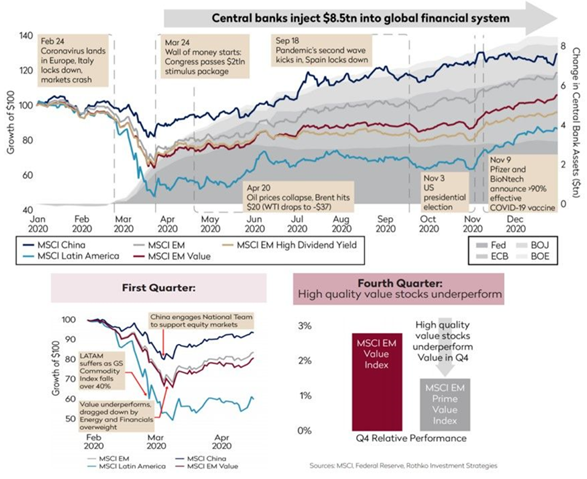

Emerging Markets in 2020: A Tale of Two Quarters

Central bank liquidity is supporting markets at the expense of yield seeking investors, on a scale that is likely to feel its impact for the next decade. However, this financial repression could very well initiate a rebound in sustainable, income-oriented Value Emerging Markets stocks in which we at Rothko Investment Strategies aim to identify and […]

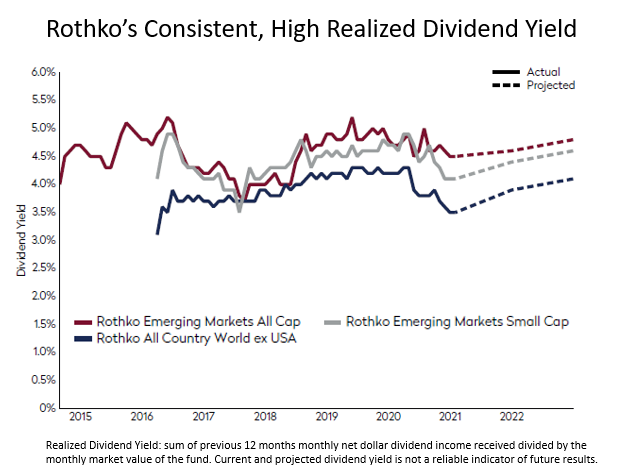

The Rothko Dividend Monitor (RDM)

Tracking the shifting economic landscape, using changing dividend payments across global emerging and developed equities markets EMERGING MARKETS (EM) IN ASIA DOMINATING DIVIDEND RESILIENCE IN 2021… We believe the strong performance of income-oriented Value strategies in EM this year is set to continue. Dividend recovery likely in the coming months across EM ex-Asia. Distortions are […]

AI is a Game-Changer for Fund Managers

At the latest webinar held by the Gillmore Centre for Financial Technology, Dr Dan Philps, Head of Rothko Investment Strategies, revealed how AI is changing the face of investment for fund managers. Check out a recording of the event and the press release here.

The National Team and Co.: China’s ¥53 Trillion Experiment

In this piece we identify the motivations driving China’s stock market intervention and describe the successes and failures of past interventions. We illustrate the numerous levers of intervention available to the Chinese authorities, and describe how these levers and the National Team and Co., who ultimately implement market intervention, all fit together. While China will […]

Revenge of the False Monikers

The opportunity in Emerging Markets (‘EM’) Small Cap equities remains one of the most compelling stories in international equities, while taking false monikers at face value, “active” and “all cap”, could cost allocators dear. We note that Rothko’s income-oriented strategies now represent the efficient frontier, making them more compelling now, than ever.

Rothko is tracking the COVID-19 Revenue shock in Emerging Markets (EM) Equities…

– Watch the relationships between Q1-2020 revenues, debt to equity, and relative returns across country, sector, cap size, and style evolve as EM quarterly filings come in over the past 4 weeks (April 28th – May 29th). – We uncover dislocations across Cap size (Small v. Large) in EM Equities. – We continue to believe […]

At Rothko Investment Strategies we believe…

-Traditional performance analysis is a blunt tool and has failed to explain the dramatic changes impacting risk and returns in Emerging Markets (EM) Equities. -Artificial Intelligence (AI) can strip out obvious return drivers and uncover meaningful insights for investors… Rothko examines EM Equities (5 years to March 31, 2020) and discovers that the most important […]