Beyond the Hype: Investment-AI and Machine Learning

Rothko’s Daniel Philps moderates and presents at the inaugural symposium for the Gillmore Institute of Financial Technology: Beyond the Hype: Investment-AI and Machine Learning Click here for the Warwick Business School Press Release. Click here for the full symposium agenda, including speakers, papers, presentations, and a recording of the event. Hear from industry experts, (including Rothko), academics, […]

Valuations available in Emerging Markets Value names and Emerging Markets Small Cap

Don’t Blink… Valuations available in Emerging Markets Value names and Emerging Markets Small Cap, we feel present “once in a generation” upside. Now is no time for allocators to blink… Rothko’s latest outlook explores opportunities for Emerging Markets (EM), specifically EM Value investing (yes, Value!) and EM Small Cap allocations.

Avoid the Crowds in Emerging Markets

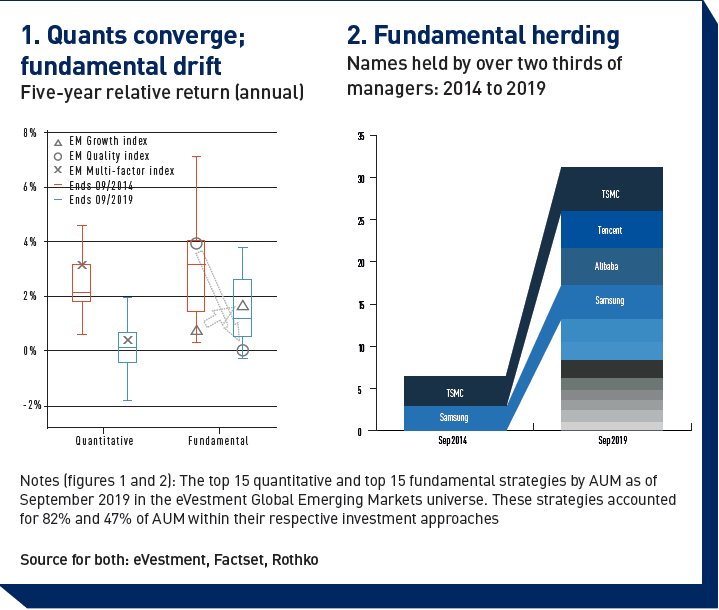

In a crowded and unpredictable world it is good to be different. Rothko’s Daniel Philps features in IP&E’s latest Ahead of the Curve Column: Avoid the Crowds in Emerging Markets (‘EMs’): – Quant EM investment strategies have been undermined by herding behavior – Investors have been piling into a common basket of names as they […]

Emerging Markets (‘EM’): Fortune Favors the Different

Most active strategies can be replicated with semi-passive ETFs, most fundamental strategies hold the same basket of stocks, and most quants have seen the basis of their returns – factors – upended. We believe the answer is obvious: Diversify away from convergent strategies, and fast.

Rothko’s Lessons from the Emerging Markets Quant Quake

Contact us below to receive the password for the presentation.

Rothko’s Dan Philps presented at JP Morgan’s “Machine Learning in Financial Markets” conference in London. We summarise the event and provide key takeaways here.

We believe disruption is certain. Artificial Intelligence and Machine Learning techniques have significant advantages over those used by traditional investment managers, both quantitative and fundamental.

Rothko’s Daniel Philps presents at NeurIPS 2019 in Vancouver on a next-generation AI to drive Emerging Markets equity stock selection

Dan’s spotlight session covers the application of a next-generation machine learning approach called Continual Learning (CL) to drive stock selection in emerging markets equity investing. The system learns without supervision, it remembers, it learns to remember… and, it produces outcomes that can be interpreted and understood by humans. Congrats to Dan, Prof. Artur d’Avila Garcez […]

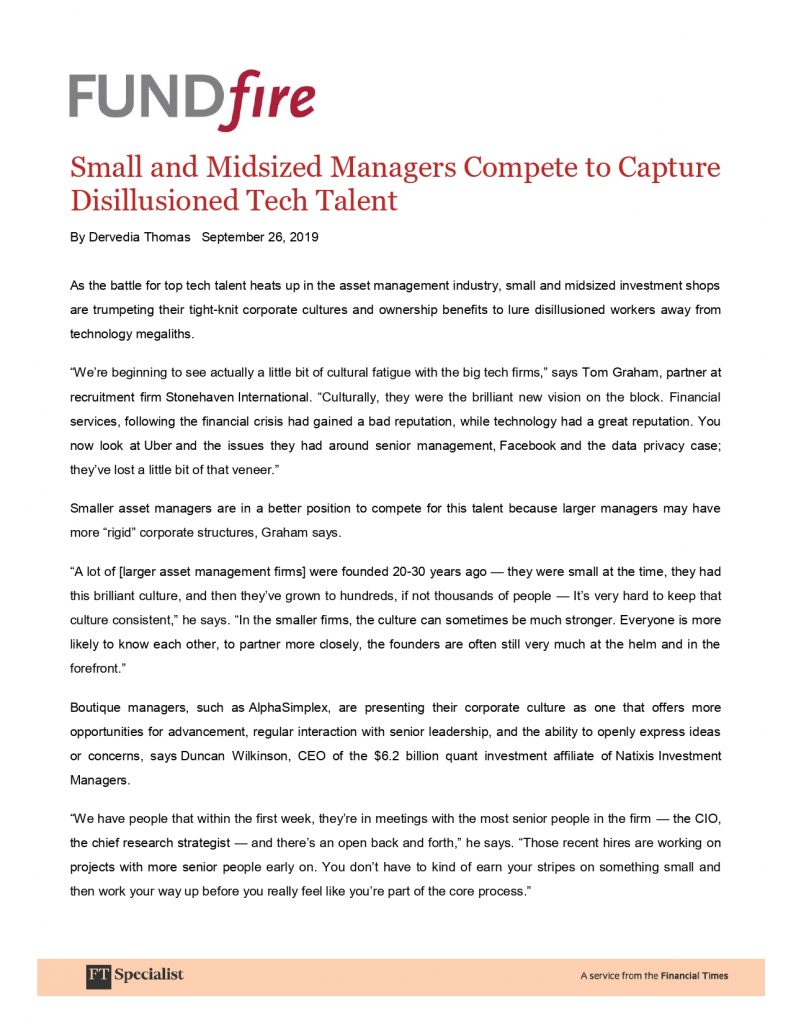

Rothko Investment Strategies’ Daniel Philps talks to FUNDfire about the challenges of old-school-quants being able to attract the right talent:

Factor strategies have had a rough ride recently, but we believe factor-quants transitioning from 1990s-era FamaFrench models to the use of #AI and #ML could impose massive style-drift risk for asset allocators. It’s tricky for these factor-quants in other ways too…

Dan Philps of Rothko Investment Strategies is featured in the Fall 2019 issue of Foresight – The International Journal of Applied Forecasting.

Dan addresses one of Rothko’s Artificial Intelligence research threads: Continual Learning (CL), and its potential application to investment decisions. Few industries are more ripe for disruption than equities investment management in 2020. Crowded 1990s-era factor quant models are still in demand, while the recent explosion in high-quality data, coupled with the technology to make sense […]

A.I.’s Rich Pickings and the QE Ratchet

Opportunities became abundant in Q2, as markets gyrated, dislocating valuations. In this piece, we investigate some of the opportunities found by Rothko, especially for our EM Small Cap strategy. We also focus on ECB policy errors to discuss why central banks are locked into providing a QE “put” for the foreseeable future (which we have […]