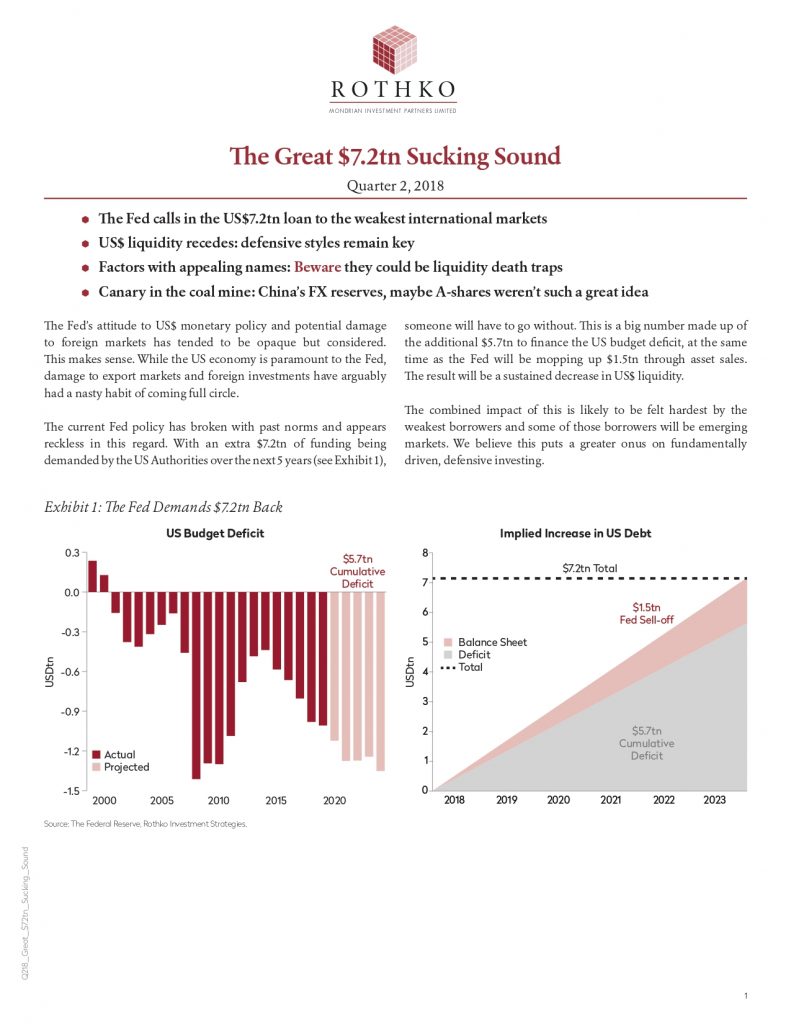

The Great $7.2tn Sucking Sound

– The Fed calls in the US$7.2tn loan to the weakest international markets – US$ liquidity recedes: defensive styles remain key – Factors with appealing names: Beware they could be liquidity death traps – Canary in the coal mine: China’s FX reserves, maybe A-shares weren’t such a great idea

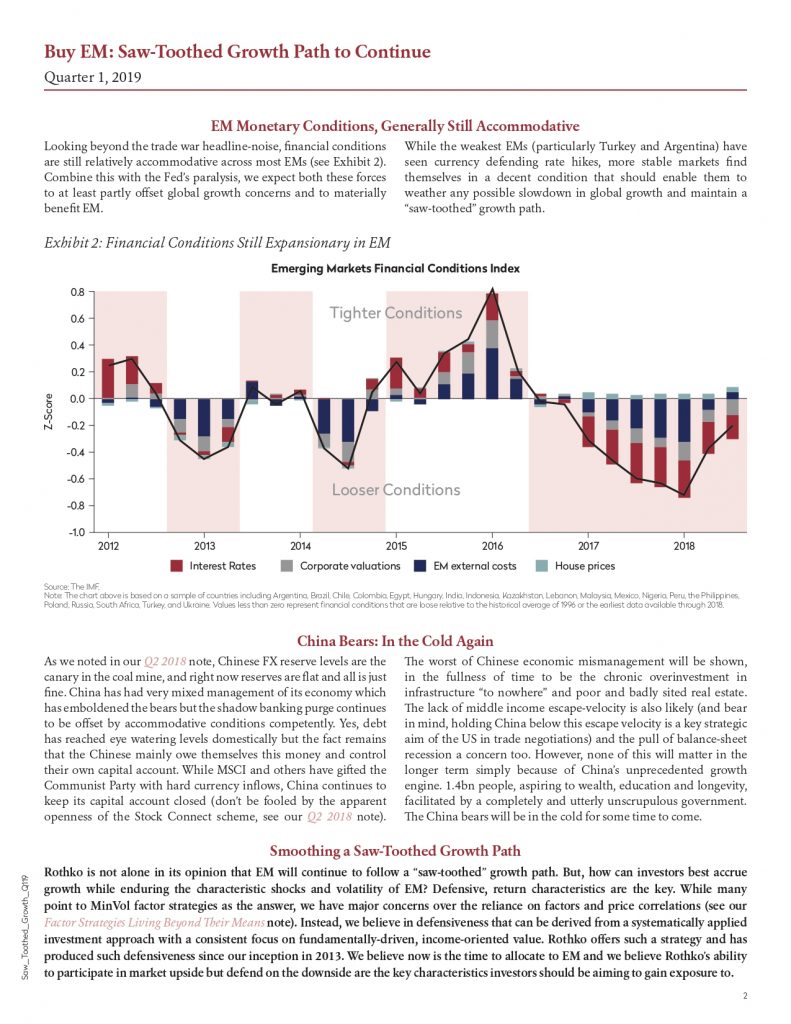

Rothko’s Outlook on Emerging Markets — Q1, 2019:

– Policy Error traps the Fed into a more benign tightening cycle – Emerging Markets have generally accommodative financial conditions – China’s monetary headroom and domestic growth potential will continue to confound the bears – Looking beyond the headline noise, the EM “saw-toothed” growth path will endure – It is a good time to allocate […]

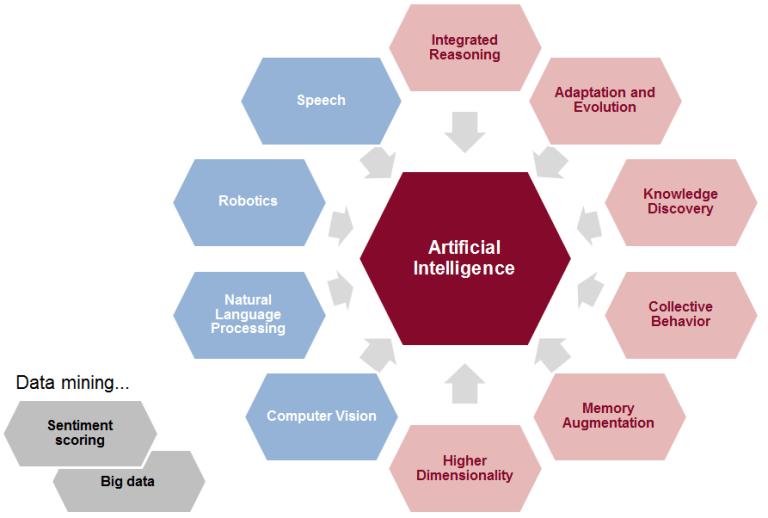

Disrupting Emerging Markets Investing with Artificial Intelligence

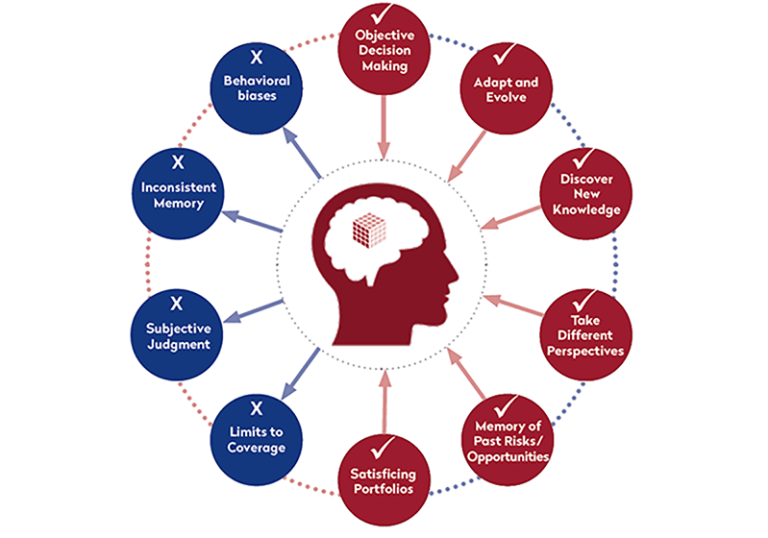

With the increasing number of new investment management technologies coming into the asset management industry, it’s not just the new technology that deserves the scrutiny but specifically how it is being fused into the investment process. It’s both interesting and revelatory to see how an innovation works its way into […]

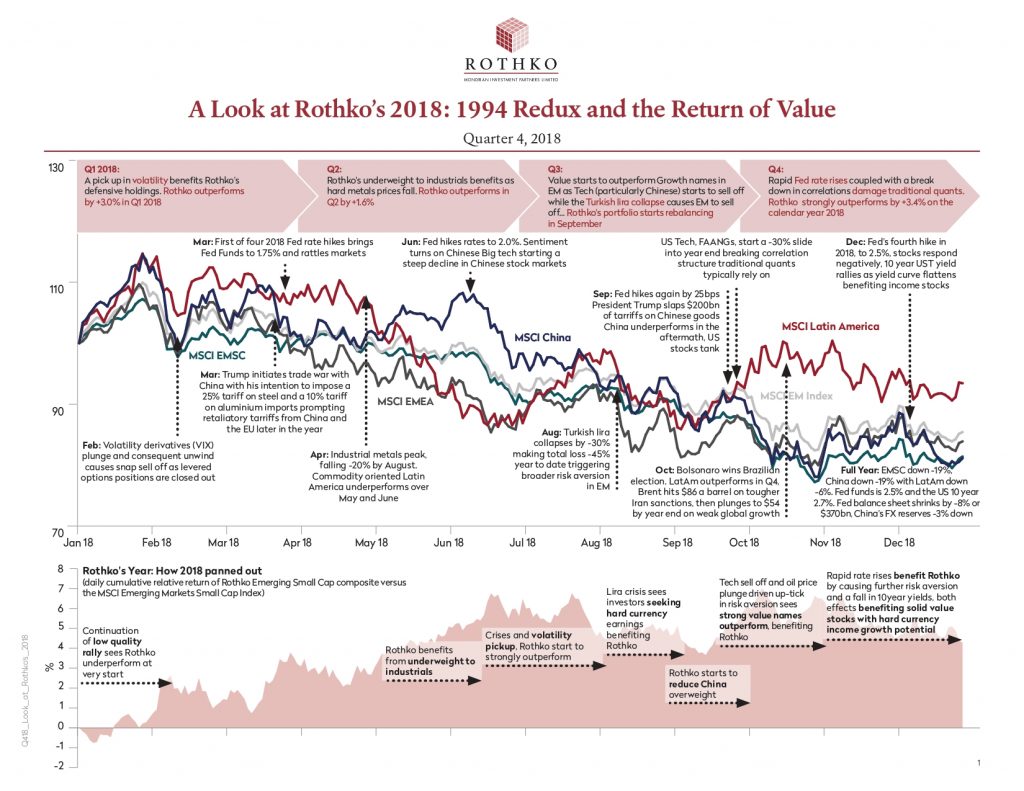

A Look at Rothko’s 2018: 1994 Redux and the Return of Value

– 1Q: A pick up in volatility benefits Rothko’s defensive holdings – 2Q: Rothko’s underweight to industrials benefits as hard metals price falls – 3Q: Value starts to outperform Growth names in EM as Tech (particularly Chinese) starts to sell off while the Turkish lira collapse causes EM to sell off – 4Q: Rapid Fed […]

Continual Learning: Will AI Give Gray Hair a Pay Cut? | CFA Institute Enterprising Investor

By Dan Philps, CFA (Head of Rothko Investment Strategies) Albert Einstein was right if he actually said, “The only source of knowledge is experience.” The quote sums up the frustration of every ambitious young analyst. The lesson? Gray hair will prevail. There simply is no substitute for experience in the investment business. Right? Well, perhaps not […]

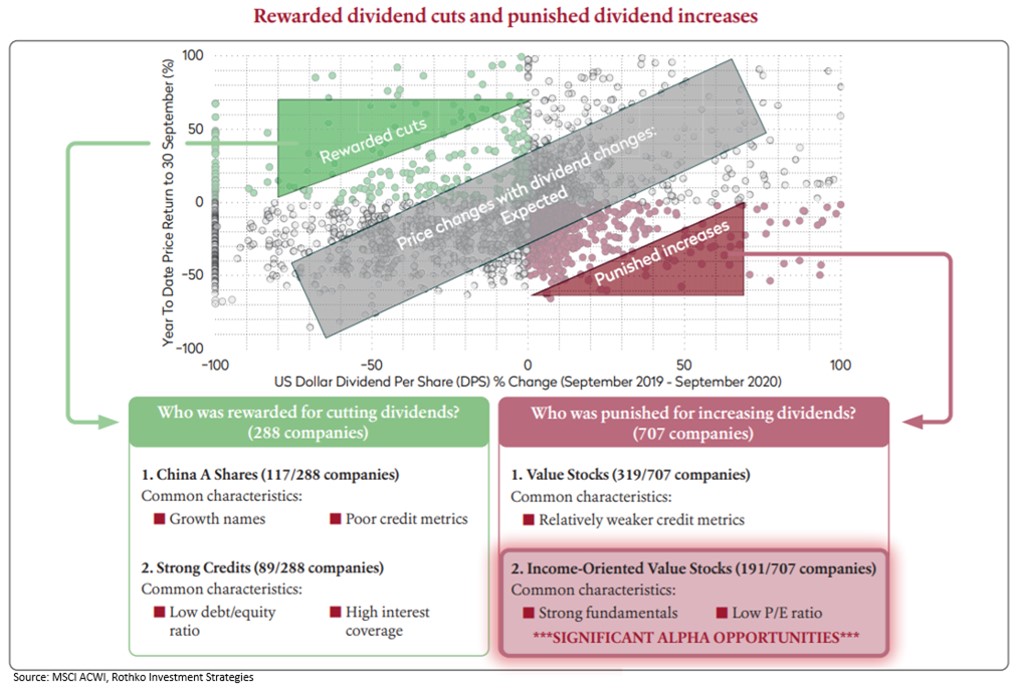

The Great Income Reversal…

Global Value stocks have sold off in this crisis, but Income-oriented, Value stocks have been thrown out, (especially in Emerging Markets). We estimate that around 200 of these global stocks maintain good fundamentals and strong US$ dividends. The Great reversal may have begun… This piece focuses on the income opportunity available to those that kept […]

Factor Strategies: Living Beyond Their Means?

– “Factor Strategies” have benefitted from large inflows recently, coinciding with better than expected performance of factor indices – Our model of “Capital-Flow-Impact” strongly suggests a link between these flows and this strong performance – Worryingly, flow-driven performance indicates crowded factor trades have the potential for a nasty reversal of factor performance – More worrying […]

Artificial Intelligence-Driven Investing: High Alpha behind the Buzz | CFA Institute Enterprising Investor

By Dan Philps, CFA (Head of Rothko Investment Strategies) Artificial intelligence (AI) may be among the latest buzzwords in finance, but applying it to investment decision making will disrupt the industry and benefit those investors who harness its power. If used correctly, AI can add high alpha potential within a more stable modeling framework.

Rising Vol and Hidden Liquidity Traps

– Cheap dollars have inflated “factor quant” strategy returns with $1.5 trillion of inflows – Volatility has started to tick up as monetary normalization starts – Avoiding liquidity bottlenecks will be key as pressure is released from the system – We believe crowded trades in factor strategies risk another “quant quake”

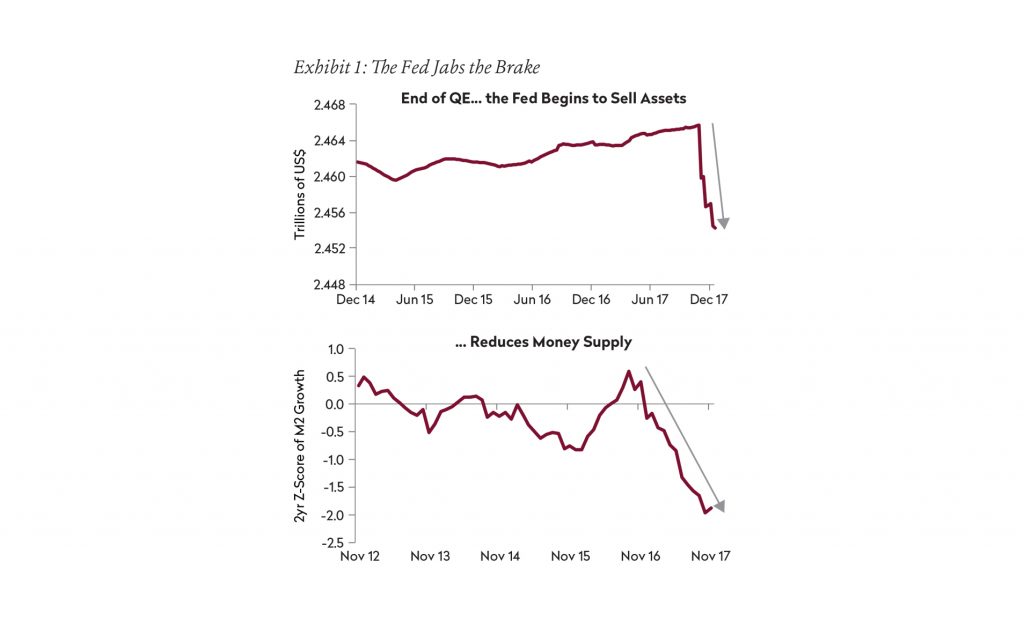

Real QE Ends… Bubble Sectors Come off the Boil

– November: US Central bank starts to reduce Treasury holdings – US$ Money supply growth continues to dip sharply in Q4 – Chinese Tech hits a bump in the road; coincidence?